How The Top 1% Mortgage Brokers Get 12-15 Weekly Inbound calls with Borrowers that have 20% Equity & 640+ Credit Scores

One Sales Letter Page & Some ADS can get you 10–15 pre-qualified calls on your calendar every week with people who actually show up and want a loan.

Dear Mortgage Broker,

If you’re tired of:

❌ Getting flooded with borrowers who don’t qualify for anything…

❌ Talking to leads with no equity, low credit, or unstable income…

❌ Wasting time with applicants who’ve already been denied by multiple lenders…

❌ Paying agencies that fill your inbox with rate-shoppers and unfundable borrowers…

❌ Spending $1,000s on ads—only to get ghosted or stuck chasing paperwork that goes nowhere…

Then this might be the last marketing message you ever need to read.

Because I’m going to show you a

new appointment-setting model

designed specifically for mortgage pros like you…

✅ Where 90–95% of prospects actually

show up

✅ Where buyers have 640+ credit scores and 20% equity

✅ And where your calendar gets filled with serious, ready-to-close borrowers

All WITHOUT:

❌ Cold calling

❌ Chasing referrals

❌ Posting on social media

❌ Or trying to “build your brand” from scratch

This model is built on one thing: High-Impact Mortgage Messaging.

We’ve used it to generate:

300+ booked calls per month for our brokers

$20K–$50K in extra monthly closings

$4.2M+ in total loan volume added in the last 6 months alone

And it works even if:

🚫 You’re a solo broker with zero tech experience

🚫 You’ve tried other agencies that burned you

🚫 You’re on a small ad budget and can’t afford to guess anymore

Let me be blunt:

It’s a waste of money to run ads if your offer isn’t hitting. And if your funnel can’t filter for high-intent borrowers? You’re just buying leads for your competition.

This system fixes that.

Using just one sales letter page and a refined ad strategy, we’ll help you turn:

$1,000 in ad spend → $14,200 in closed deals

$2,000 in ad spend → $31,800

$3,500 in ad spend → $54,100

Because when the right words meet the right buyers, you don’t chase leads…

You attract them.

This is more than a funnel.

It’s a complete appointment-setting engine that delivers:

Verified contact info

Financially qualified borrowers

A calendar booked solid with 12–15 serious appointments every week

The best part?

You don’t need to lift a finger. We build the whole thing for you. You just show up and close.

HERE’S HOW WE DO IT!

We create a done-for-you lead generation system

We create a premium service package designed to attract high-intent mortgage buyers who are actively looking to fund loans now—not tire-kickers or cold leads.

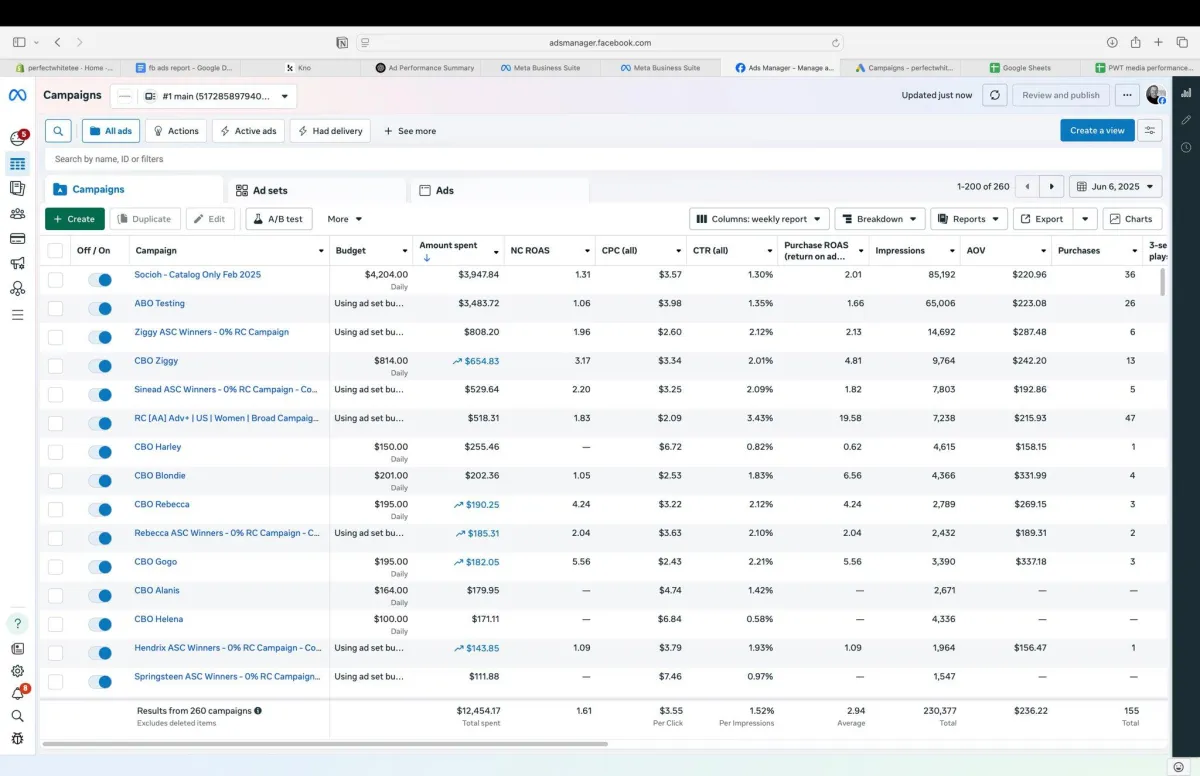

We implement strategic Facebook ad campaigns combined with long-form sales letters and CRM automation to ensure consistent, scalable results.

We generate 15–20 pre-qualified sales appointments weekly with mortgage-ready clients who have already raised their hand and want to talk now, specifically targeting those with 640+ credit scores for mortgages and 20-30%+ home equity for HELOCs.

We delegate all lead gen, funnel building, ad management, and follow-up automation to our expert team so you can focus 100% on closing deals.

We optimize for long-term scalability with a predictable pipeline that reduces burnout and allows you to take real vacations without worrying about where the next deal is coming from.

Your mortgage business grows at an accelerated pace, and you experience increased credibility in your market while becoming the go-to expert in your area.

In just 2 weeks, you will move from unpredictable income and ghosted leads to a fully booked calendar of ready-to-close buyers—without cold calling or trial-and-error marketing.

It takes just 7 days to build the fully automated lead engine that fills your calendar daily and scales your revenue without burning out.

Yes, you read that right…

It takes only 7 Days to build The Digital Originator System™.

If you’re ready to eliminate revenue inconsistency for good and finally scale your mortgage business with qualified leads flowing in daily…

Then let me introduce myself…

I’m Andro Durruthy.

I’m the Founder of Heirloom Union, a results-driven agency focused exclusively on helping mortgage brokers book more pre-qualified appointments without chasing leads or wasting money on generic marketing.

Over the last 1 year, my agency has helped mortgage professionals across the USA, Canada, Australia, and the UK generate thousands of high-intent appointments using proven systems built specifically for this industry.

I’ve worked with independent brokers, loan officers, and small firms—ensuring we deliver real results without fluff or fake promises.

And I built Heirloom Union from the ground up… starting with zero connections and no team—just proven strategies that actually convert.

Today, I lead a team of top-tier specialists managing nationwide client campaigns that consistently deliver 15+ pre-qualified appointments per week for each broker we work with.

On a monthly basis, we generate hundreds of qualified leads for our clients—helping them close more loans while working fewer hours.

My entire system operates remotely with precision-driven execution, allowing me to serve mortgage brokers across North America, Europe, and Australia with predictable results.

HERE’S HOW THE DIGITAL ORIGINATOR SYSTEM WORKS

FROM CHASING UNQUALIFIED LEADS TO WAKING UP WITH 15+ PRE-QUALIFIED APPOINTMENTS WEEKLY

The first step is about shifting from unpredictable lead flow and wasted time on tire-kickers to having a consistent stream of high-quality mortgage prospects booked directly into your calendar—so you can focus on closing deals, not chasing them.

Learn our Authority-Driven Positioning strategy used by top-performing mortgage pros to generate 15–20 booked appointments per week while working fewer hours.

Discover how to position yourself as the go-to mortgage expert in your local market so that you attract serious buyers who show up ready to borrow.

Implement Psychological Pre-Framing to turn cold traffic into ready-to-book leads who already see you as the trusted advisor before you ever get on a call.

After Step 1, you will have a client-attracting sales message and positioning system that filters out tire-kickers and fills your calendar with serious, high-intent buyers.

IDENTIFYING HIGH-INTENT MORTGAGE LEADS WHO ACTUALLY CONVERT

Success in mortgage lead generation depends on targeting the right audience—people who are actively looking for help and ready to move forward. This step shows you how to eliminate low-quality leads and lock in prospects who are eager to borrow loans now.

Learn how to pinpoint mortgage-ready buyers with high buying intent so you stop wasting time on ghosters and start talking only to those who are ready to close.

Discover how to structure your lead system for high-ticket closings—adding $20K–$50K in extra monthly revenue—while ensuring you're not wasting money on unqualified clicks.

Implement a systemized daily process that takes less than 10 minutes a day to keep your pipeline full of ready-to-close appointments without babysitting follow-ups.

Gain access to untapped local buyer pools most brokers overlook, allowing you to dominate your area without competing on price or running generic ads.

After Step 2, your lead generation system will be structured to attract only high-quality, ready-to-book leads who convert into funded loans, giving you consistent ROI every month.

BUILDING YOUR AUTOMATED MORTGAGE APPOINTMENT ENGINE

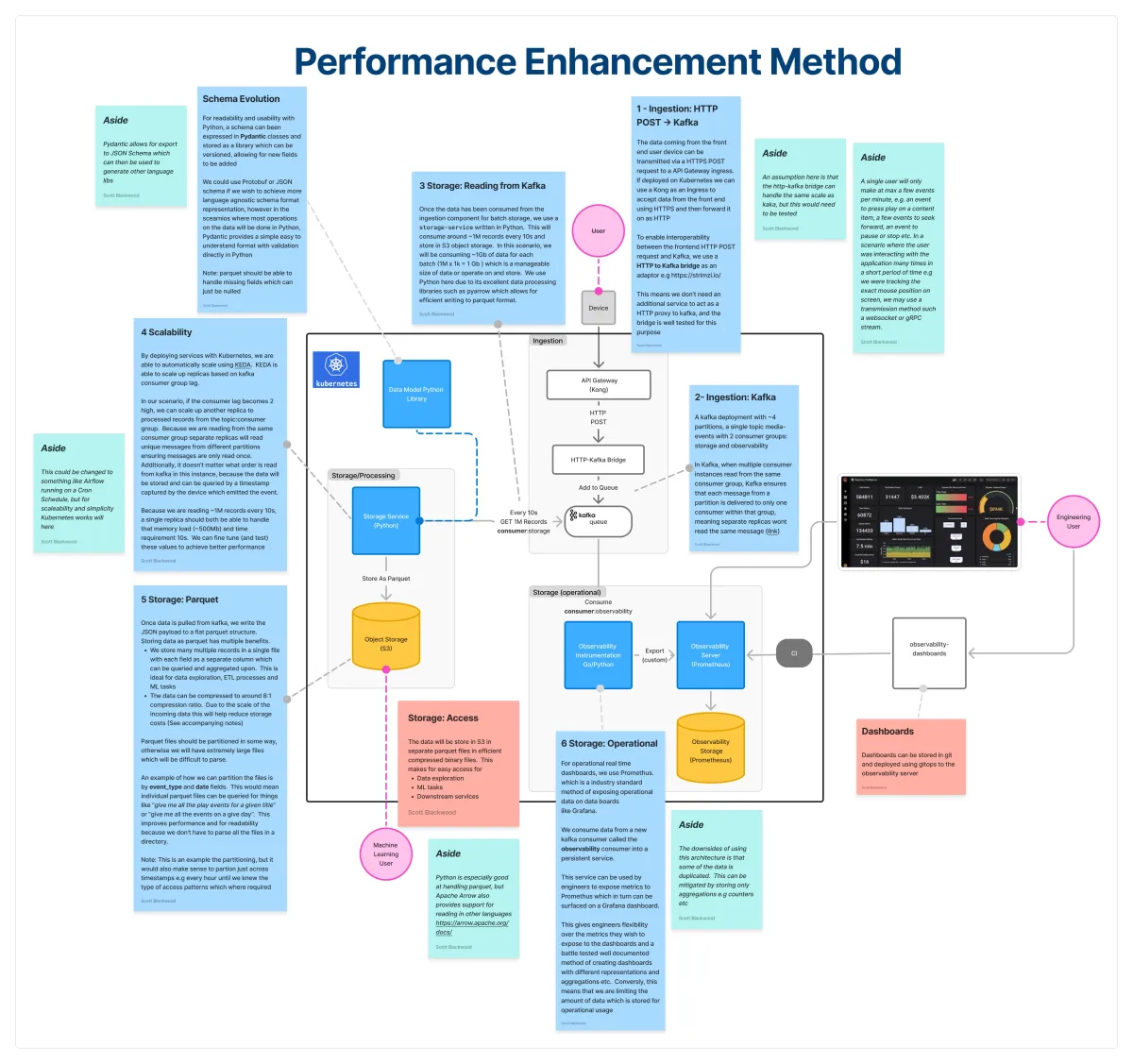

At this stage, we will implement a fully automated appointment engine using Facebook Ads + Go High Level, ensuring you generate a steady stream of pre-qualified buyers without doing any manual outreach or chasing leads.

You will learn how to leverage precision-targeted Facebook Ads and long-form Sales Letter Funnels to attract pre-sold mortgage clients without cold calling or posting content daily.

You will master the step-by-step process of launching conversion-optimized campaigns that book 12–15 qualified appointments/week—so you can close more deals with less effort.

You will turn a $500–$1,000 weekly ad budget into $20K–$50K in funded loan volume per month by plugging into our proven ad + funnel + nurture system.

You will be able to manage all follow-ups, reminders, and scheduling through a centralized CRM built inside Go High Level—ensuring no lead ever falls through the cracks.

After Step 3, you will now have a scalable and automated lead flow engine that consistently delivers high-quality appointments directly onto your calendar so you can focus fully on closing loans and increasing revenue.

MASTERING CONSISTENT LEAD FLOW WITHOUT BURNOUT

At this stage, you will implement our streamlined execution system that eliminates manual tasks and guesswork, ensuring consistent growth without overworking or burning out.

You will learn how to use data-driven decisions and performance tracking inside Go High Level to continuously optimize appointment rates and reduce no-shows—without hiring help or wasting time manually following up.

You will use our plug-and-play automation templates (texts, emails, push notifications) to simplify your workflow and ensure prospects stay warm until they book or close.

You will implement a proven performance enhancement method that boosts your show-up rate by up to 70%, ensuring more conversations turn into funded deals—with zero extra effort from you.

You will master strategic thinking around funnel performance and ad metrics so every dollar spent produces measurable ROI—and gives you full control over your pipeline growth.

After Step 4, you’ll have a predictable execution model that ensures ongoing appointment flow, higher conversions, and long-term stability—without needing to micromanage every part of the process.

SCALING FROM SOLO BROKER TO MARKET-DOMINATING MORTGAGE BRAND

At this stage, you will implement our built-for-scale profit system that lets you grow revenue without adding staff or spending more hours at your desk—ensuring long-term growth with minimal complexity.

You will learn how to scale your appointment volume from 15/week up to 30+/week using our CBO-based ad strategy while eliminating bottlenecks in follow-up and compliance management.

You will implement an automated profit engine that handles lead gen, qualification, nurturing, and booking—so scaling doesn’t mean working more hours or hiring more people.

You will use our performance-based scaling model inside Go High Level + Facebook Ads Manager that ensures every new dollar spent produces more revenue with less risk—and no wasted spend on gimmicks or cold leads.

You will master profitability-focused decision-making so you can secure bigger deals, become the trusted expert in your market, and grow beyond referrals or inconsistent pipelines forever.

After Step 5, you'll have a fully optimized business model built for long-term expansion—a scalable mortgage marketing machine that delivers qualified leads daily while you focus on what actually matters: closing deals and growing revenue.

ARE YOU READY TO WAKE UP TO 15+ PRE-QUALIFIED MORTGAGE LEADS BOOKED DIRECTLY INTO YOUR CALENDAR

- Scale Your Business In 2025 -

Here's a Recap of Everything You Get:

A done-for-you lead engine that attracts high-intent mortgage buyers.

12-15 pre-qualified appointments weekly —no cold calls or manual outreach required.

Automated follow-up and nurture to ensure no lead slips away.

Proven strategies to boost your authority and close 5-10 additional loans monthly.

A scalable, predictable pipeline

built to accelerate your growth and eliminate stress.

Your status as the trusted, in-demand mortgage expert.

Let's explore How The Digital Originator System can Transform your Business.

Copyright 2025 | Heirloom Union

Terms and Conditions | Privacy Policy

Este sitio no es parte del sitio web de Facebook™ ni de Facebook™ Inc. Además, este sitio NO está avalado por Facebook™ de ninguna manera. FACEBOOK™ es una marca registrada de FACEBOOK™, Inc.